Just as the automotive industry recovers from the semiconductor chip shortage brought on by the pandemic of 2020/21, analysts are warning another is just on the horizon.

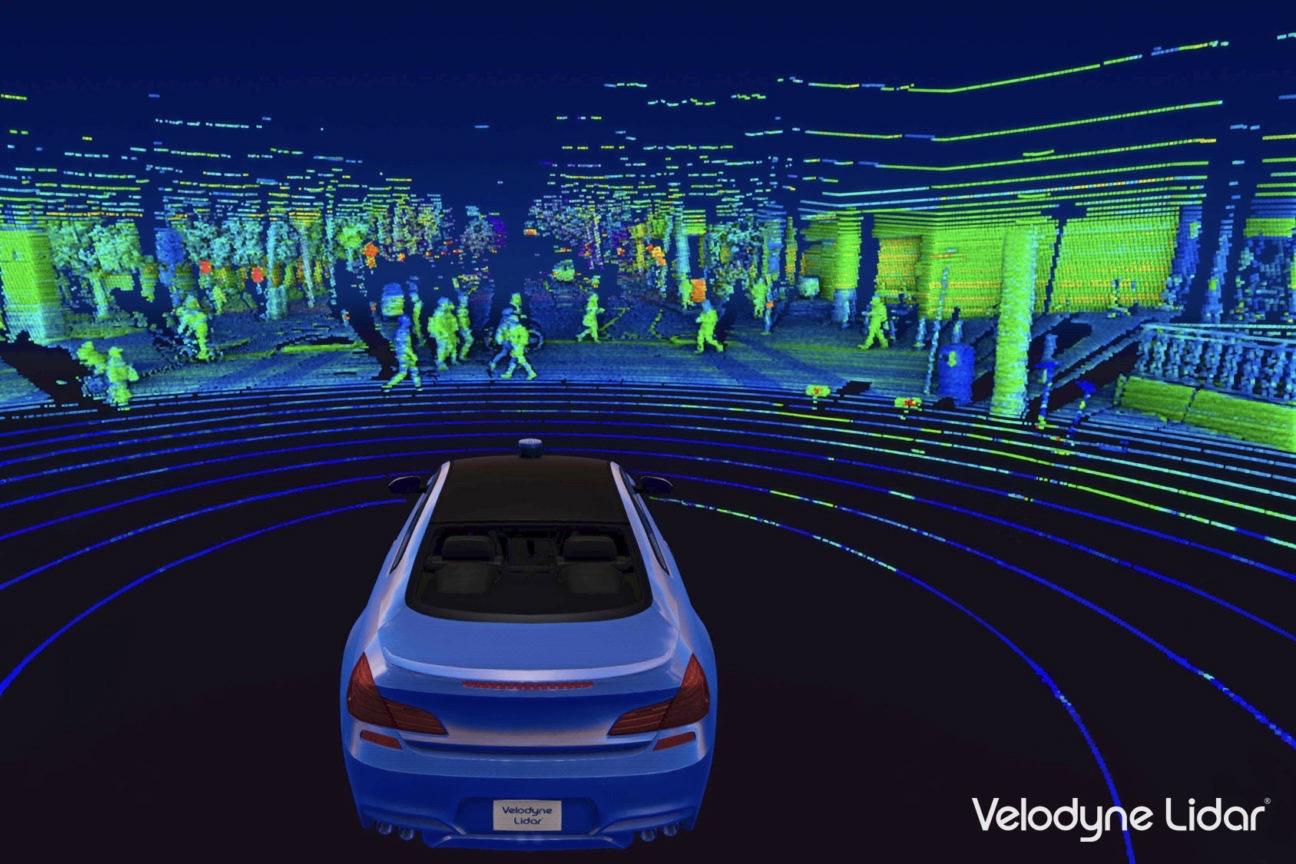

Semiconductors have become vital for feature-packed new cars, with thousands of the small computer chips being fitted – controlling everything from electric seats to the advanced driver assistance systems (ADAS), which can autonomously brake and steer the car away from an obstacle if an imminent collision is detected.

As reported last month, experts now warn that a shortage of dynamic random access memory (DRAM) chips could be about to hit the automotive sector, as suppliers of the vital components prioritise manufacturing for data centres used for artificial intelligence (AI).

CarExpert can save you thousands on a new car. Click here to get a great deal.

According to a report published by S&P Global, high profit margins for hardware supplied to the AI industry are shutting out the automotive industry – despite production of semiconductors increasing in 2023 as a response to the COVID-19 shortage.

It’s estimated 88 per cent of DRAM chips used in new cars are supplied by just three companies.

However, while the previous shortage primarily revolved around relatively primitive components, the looming supply issues relate to more advanced DRAM chips – which may disproportionately affect premium and technology-rich vehicles.

With constrained supply of DRAM semiconductors and dramatically increasing appetite, prices could skyrocket by between 70 and 100 per cent in 2026, compared to 2025 prices.

Given the number of semiconductor chips used in vehicles – and creeping regulations for mandated safety technologies – this means prices for new cars could see a significant spike before the end of the decade.

Accelerating the problem is the phasing out of older styles of chips by manufacturers, despite these products still being in widespread use in automotive applications – forcing automakers to upgrade to newer semiconductors, resulting in greater demand.

While they’re no longer being made for consumer electronics, S&P estimates production of these older-generation chips for car companies will continue until 2027.

Given the majority of ADAS technology used on new cars rely on these outdated semiconductors, automakers will be forced to upgrade their systems to suit the newer chips in just two years.

MORE: The next thing that could hurt global vehicle production